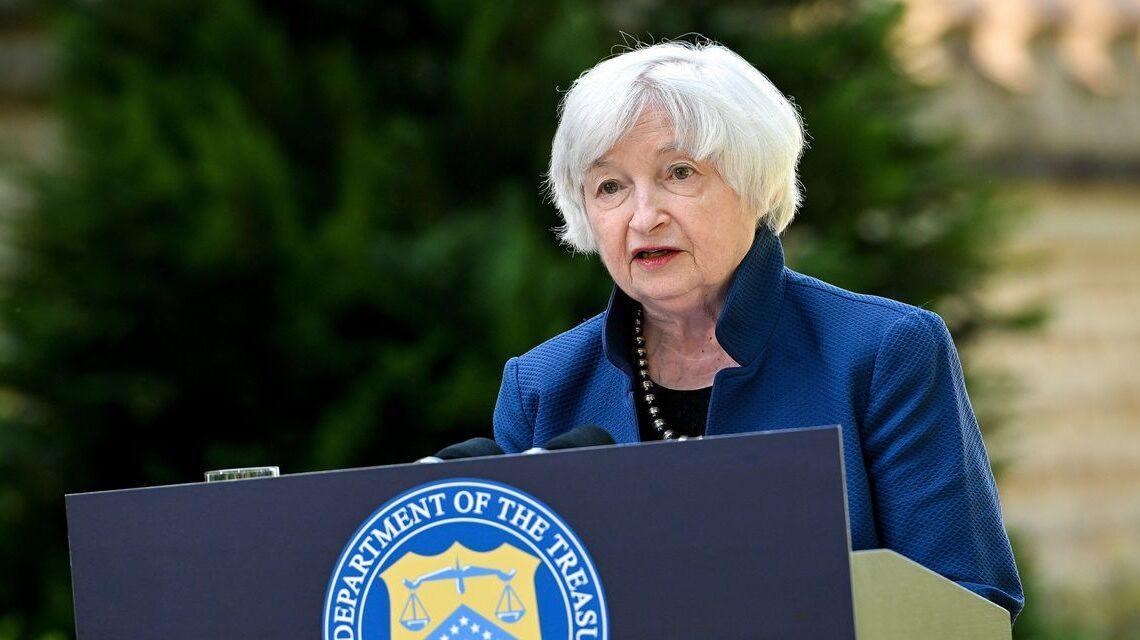

BONN, Germany—Treasury Secretary

Janet Yellen

said the U.S. would likely prevent U.S. investors from receiving payments on Russian debt, a decision that could push Russia toward default.

Currently, the U.S. has carved out an exemption, set to expire on May 25, in its sanctions campaign against Russia to allow for sovereign debt payments. Without it in place, banks and investors won’t be able to process and receive bond payments made by the Kremlin, likely prompting Russia’s first default on its foreign debts since 1918.

Ms. Yellen said the U.S. would likely let the exemption expire.

“There has not been a final decision on that, but I think it is unlikely that it would continue,” Ms. Yellen said during a press conference ahead of a meeting of the finance ministers of Group of 7 major economies, in Germany.

Russia has managed to stay current on over $2.5 billion in foreign debt payments since the onset of the war with Ukraine, largely thanks to the sanctions carve-out, although the U.S. has steadily tightened Russia’s ability to make payments, including new sanctions in April that cut off the Kremlin’s access to U.S. bank accounts for sovereign debt payments.

Asked about the possible economic consequences of the move, Ms. Yellen said the U.S. and its partners have already largely cut off Russia’s access to foreign credit.

“Russia is not able to borrow in global financial markets. It has no access to capital markets. If Russia is unable to find a way to…

Click Here to Read the Full Original Article at WSJ.com: World News…