Congress is returning to Washington for a lame-duck session, and Democrats think they’ve found the perfect holiday gift for hard-to-shop-for American voters: Subsidies for children. The left and some Republicans will argue that only childless ghouls could oppose cash for kids, but the tax credit is a parable about good intentions, unintended consequences, and the insatiable entitlement state.

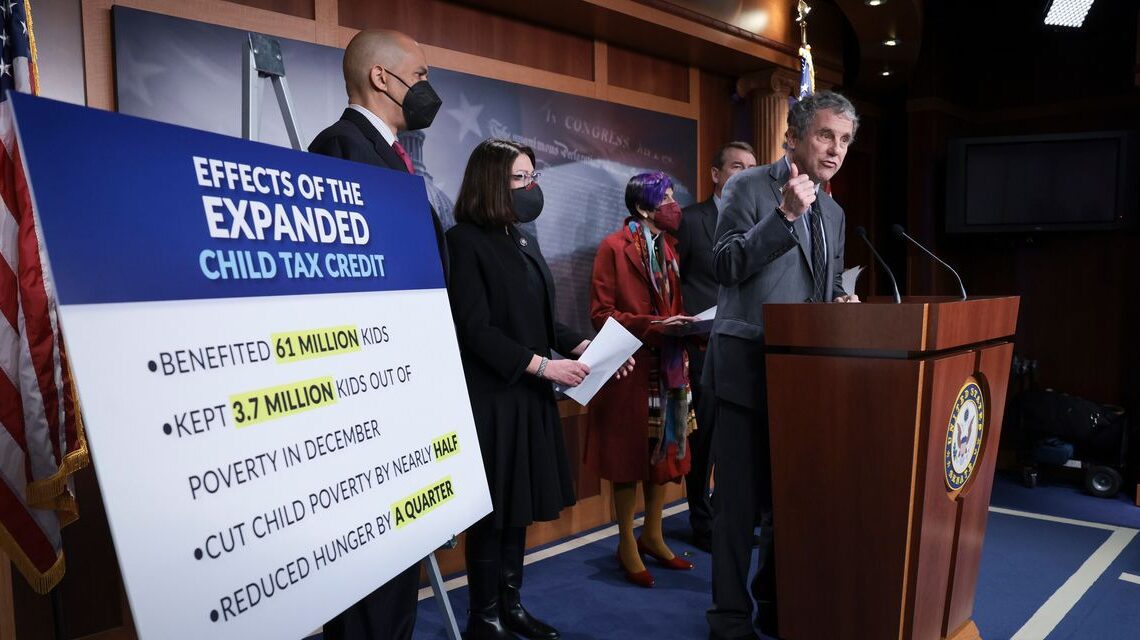

A core Democratic priority in Congress is resurrecting a $3,000 child tax credit for dependents ages six and up, with a $600 bonus for younger children. Congress passed such a larger credit for 2021, dressed up as pandemic relief, with half of the benefit payed in monthly checks. By some miracle the payments expired, but Democrats are eager to bring it back, if not this month then in the new Congress.

Scott Hodge

nearby lays out the regrettable history of the child tax credit, which he helped propose in the 1990s. The credit was born as a $500 per-child benefit for middle-income families, but has since degenerated into one more cash transfer payment. The Internal Revenue Service is now another turnstile of the welfare state.

That’s because over time Congress made more of the credit “refundable,” which means available to those who don’t owe federal income taxes. By 2004 the credit was worth $1,000; those with $10,000 of earned income could claim a portion of it. Republicans in 2017 doubled the benefit to $2,000, and this year filers need a mere $2,500 of income to qualify. The increase to up to $3,600 eliminated any income requirement, handing out the full benefit as a universal basic income for people with children.

As Mr. Hodge explains, the child tax credit “has become one of the largest federal income-transfer programs” and “one of the leading reasons that more than 40% of all filers pay no income tax.” Meanwhile, the top 1% of taxpayers paid more than 38% of individual income taxes in 2019, according to the Tax Foundation. That is fiscally and politically unsustainable.

The child tax credit has also been an engine for higher tax rates. Democrats can raise the top rate on income north of 40% while protecting suburban middle-income voters from the pain thanks to the kid discount. The full Democratic allowance would cost $1.6 trillion over 10 years, and these credits are an expanding black hole for revenue that could…

Click Here to Read the Full Original Article at RSSOpinion…