Learning in college is as much about life lessons as it is about the lectures. It might be the first time you’re managing things on your own — particularly your finances — and as you apply for jobs and search for apartments, you may also be increasing the amount of personal data you put online. We gathered up the budgeting apps we have tried and ultimately recommend, as well as services that can help you keep track of passwords and protect your online activities. These are all tools we wish we’d known to use when we headed off as undergrads, and hopefully they’ll make the adulting parts of college a little more manageable.

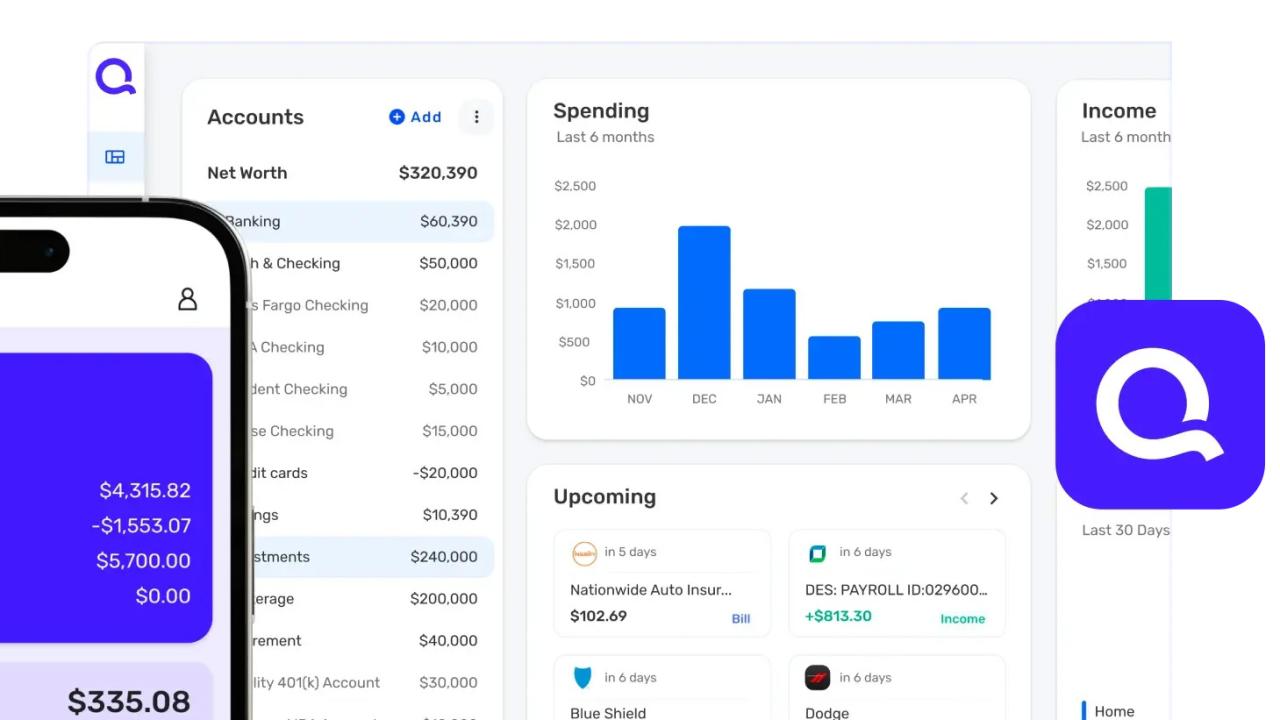

When Mint shut down, we went looking for the best budgeting app to replace it and landed on Quicken Simplifi. Unsurprisingly, the thing that stands out most is the app’s simplicity, with a clean interface and a learning curve that’s rather low. It’s just as good at categorizing expenses as other apps (which is rarely great, but, as in this case, just fine) and the budgeting feature was intuitive to set up and understand.

Unfortunately, there’s no free trial and you have to set up your account fresh, no using your Apple or Google ID to get started. But Simplifi does offer a 30-day money back guarantee, so if you decide it’s not for you before the month is up, you’re not out the $4 monthly fee. But overall, it’s not as expensive as the competition, which we think is pretty important for something that’s meant to help you control your spending.

For help creating a more formal budget, a few Engadget staffers use YNAB (You Need A Budget) and we recommend it in our guide to student budgeting. It’s based around a theory that imposes four “rules” to improve your money management, and learning those principles now will benefit you long after graduation.

The browser and mobile app interfaces are pretty easy to use, and YNAB has a ton of instructional content for newbies that can point you in the right direction when you’re first setting up expense categories, debt trackers and sinking funds. It’s usually $15 per month or $99 per year, but students who can prove they’re in school can get a year for free.

Between loans, jobs and, if you’re lucky, scholarships and financial aid, a student’s “extra” money can be pretty limited. Goodbudget is a budgeting tool that translates the envelope technique to an app format, earmarking your money for the…