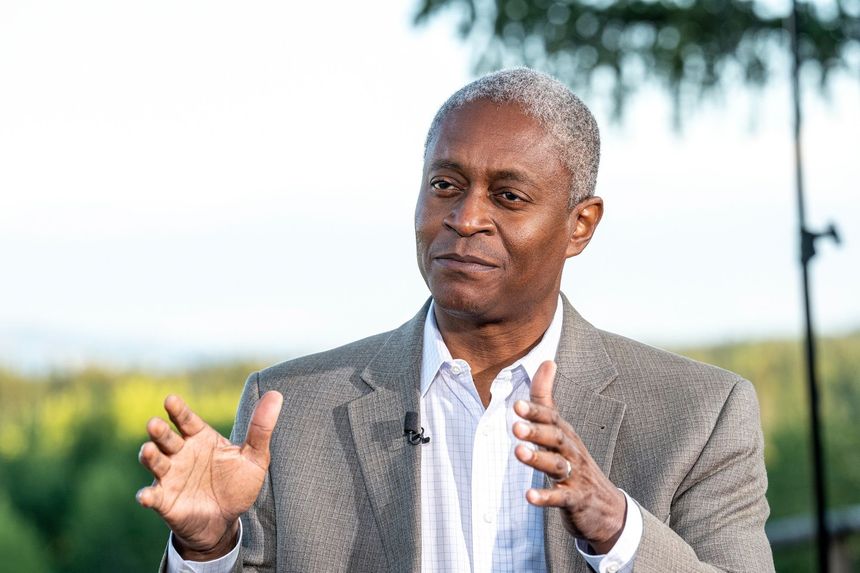

Fed Bank of Atlanta President Raphael Bostic

Photo:

David Paul Morris/Bloomberg News

You’d think the people who delivered the worst inflation in 40 years and may now cause a recession to cure it would refrain from criticizing anyone else’s economic policy. But self-reflection isn’t common at the U.S. Federal Reserve, as Fed Bank of Atlanta President

Raphael Bostic

demonstrated on Monday.

Mr. Bostic was asked about the market response to the tax cuts and deregulation proposed on Friday by new British Chancellor

Kwasi Kwarteng,

and if that increases the odds of a global recession. “It doesn’t help it,” he replied in an online discussion hosted by the Washington Post.

“What we have seen in the reaction to the proposed plan is a real concern, a fear that the new actions will add uncertainty to the economy,” Mr. Bostic added. “The proposal has really increased uncertainty and really caused people to question what the trajectory of the economy is going to be.”

Now that takes nerve. No one has done more to introduce economic uncertainty around the world than the Fed. First it dismissed emerging inflation as “transitory.” Once it finally caught up to reality, the Fed was indecisive in confronting inflation. Now it is finally tightening money in earnest, contributing to the strong dollar that is hurting the British pound among most other global currencies.

The chart nearby tracks the pound-U.S. dollar exchange rate since the start of this year. The British currency was worth as much as $1.37 in early January, but by late February it was beginning a gradual decline. By last Thursday, Sept. 22, it was down to $1.13 before Mr. Kwarteng laid out his tax proposals on Friday. The pound had already lost about 17% of its value this year. It fell another 5% or so on Friday…

Click Here to Read the Full Original Article at RSSOpinion…