Larry Fink

can’t catch a break. He’s chairman and CEO of

the largest investment manager in the world, with $8.5 trillion of assets under management. In the battle over sustainable investing and the spread of environmental, social and governance policies across Wall Street, both sides are gunning for him.

Red-state governors and Republican attorneys general—many from oil- and gas-producing states—have attacked Mr. Fink as the leading industry spokesman for ESG, which they view as an elaborate cover for the climate-change movement and a backdoor means of reducing carbon emissions by starving the energy industry of investment capital. Using a shoot-the-messenger approach, 19 states have publicly called BlackRock on the carpet with regard to ESG. Texas and West Virginia are already starting to claw back state business from the company.

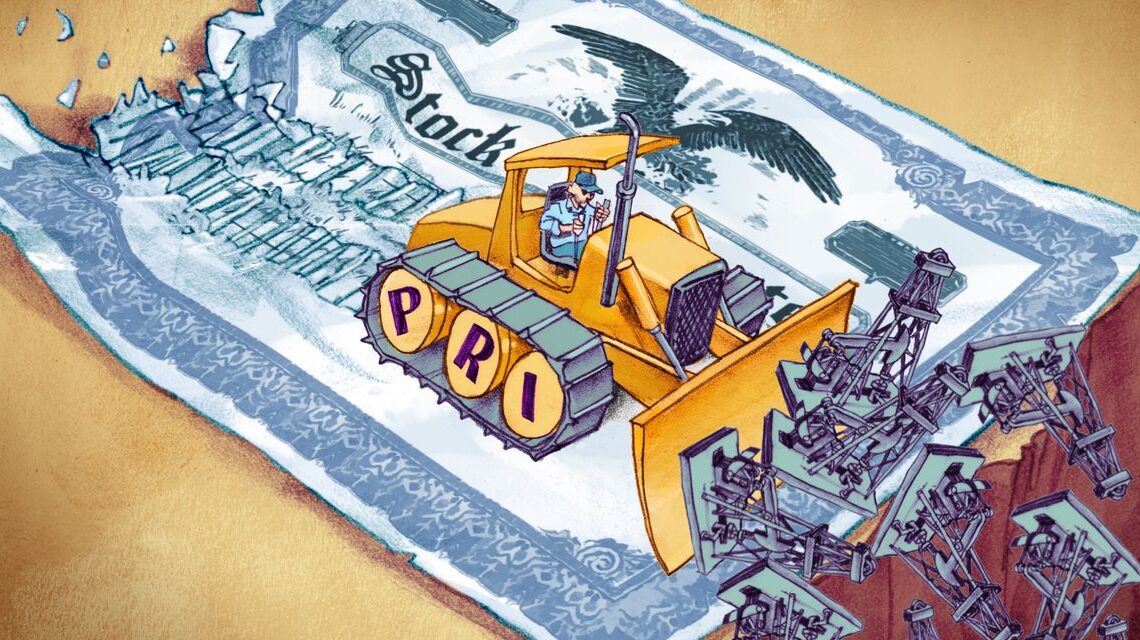

But BlackRock also sits squarely in the sights of ESG advocacy groups such as the United Nations-supported Principles for Responsible Investment, or PRI. It would like nothing better than for BlackRock to issue a company press release forswearing oil and gas companies in all the funds it manages. Turning Mr. Fink on this point has become PRI’s strategic mission because of the obvious domino effect it would have on Wall Street.

Clearly, Mr. Fink agrees with the ESG argument. His annual missives to the business community reflect his personal beliefs. He sits on the board of trustees of the World Economic Forum, and his family foundation helps fund the Center for Sustainable Business at the NYU Stern School of Business. He puts his time and his money where his mouth is on ESG.

Since sustainability policy is pushed down from the corporate suite at every firm on Wall Street, it would be simple for Mr. Fink to direct BlackRock portfolio managers to stop buying oil and gas investments in their respective funds. He hasn’t done so. Why?

Roughly two-thirds of BlackRock’s assets are composed of passive index and exchange-traded funds, where the firm has no call on security selection and can’t screen out oil and gas names. On the active side, though, energy investments remain well-represented in the firm’s debt and equity mutual funds. Pulling the plug on fossil-fuel investments would pose a serious competitive threat to the buy-side behemoth that Mr. Fink and his…

Click Here to Read the Full Original Article at RSSOpinion…