Now that the U.S. economy seems to be turning the corner on the worst inflation in 40 years, it’s important to remember that sound money and sound finances go hand in hand. While the Federal Reserve will continue to focus on reducing demand through restrictive interest rates, Congress should concentrate on expanding supply. Yet it all needs to be accomplished while also pursuing a balanced budget.

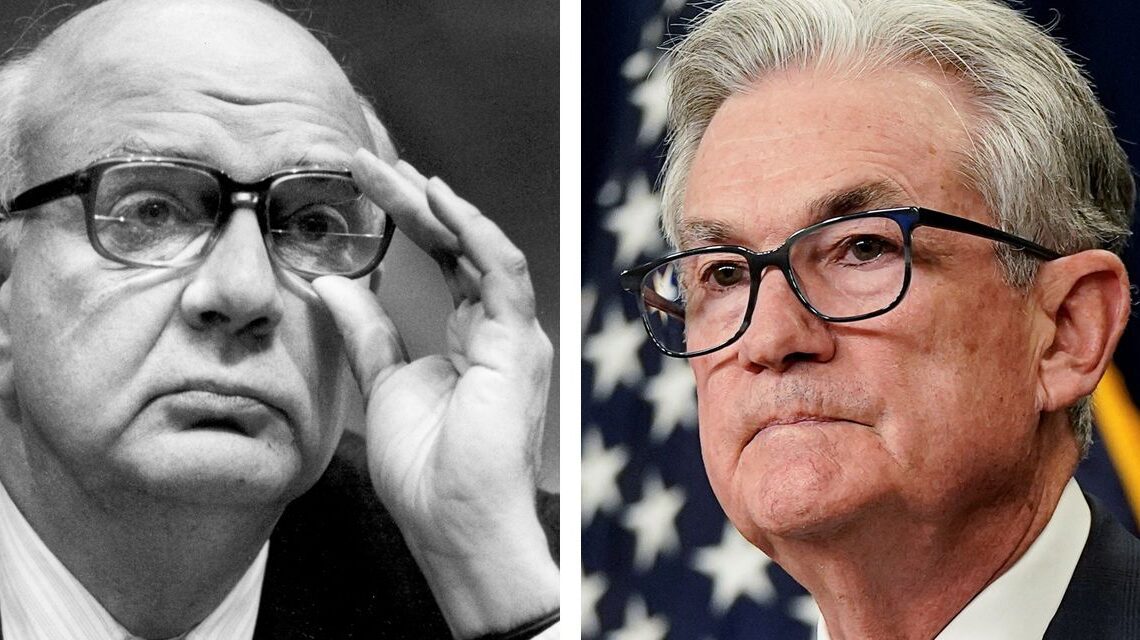

Sound impossible? Going back those 40 some years, we can draw lessons not only about how to coordinate monetary and fiscal policy effectively. We can also see how former Fed Chairman

Paul Volcker

endorsed the pro-growth objectives of the Reagan administration while maintaining the independence of the Federal Reserve.

When inflation upends budgetary projections and financial planning, both at kitchen tables across the nation and throughout the halls of government, it needs to be confronted. The U.S. central bank has stood ready to accept responsibility for stable prices since 1977, when Congress specifically mandated that it “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates” through an amendment to the Federal Reserve Act.

Volcker was powerfully aware of this assignment and committed to fighting inflation when he was nominated by President

Jimmy Carter

to lead the Fed in 1979. Under Volcker, the Fed sought to restrain money supply growth by targeting the level of bank reserves in the system, allowing the daily interest rate to fluctuate. When

Ronald Reagan

was inaugurated as president in January 1981, the effective federal-funds rate exceeded 19% and unemployment stood at 7.5%.

The Reagan administration’s program for economic recovery announced on Feb. 18, 1981, took aim at reversing the debilitating effects of inflation by revitalizing economic growth. The plan acknowledged the importance of a stable and reliable monetary framework as part of an integrated and comprehensive economic program, but its primary thrust was to release the strength of the private sector and “rekindle the nation’s entrepreneurial instincts and creativity.”

The Reagan plan consisted of four parts: “(1) substantial reduction in the growth of federal expenditures, (2) significantly reduced federal tax rates, (3) prudent…

Click Here to Read the Full Original Article at RSSOpinion…