When President Biden came to the Senate in 1973, the cumulative gross debt of the U.S. was a half-a-trillion dollars, and the debt held by the public was 26.5% of gross domestic product. By the end of 2008 the federal debt held by the public was 39.2% of GDP. In the subsequent 14 years, the debt ceiling has ballooned to over $30 trillion from $10 trillion, and the debt held by the public has reached 100% of GDP. Since 2008 economic growth has slowed, government spending has exploded and for every additional dollar of income produced by the economy the federal government has borrowed an astonishing $3.16.

During the pandemic, the federal government spent more in two years than it had ever spent in three. Though the pandemic has been over for more than a year, inflation-adjusted 2023 nondefense discretionary spending is still $155 billion above the prepandemic level while real defense spending is down by $6 billion. Not surprisingly, the Treasury has notified Congress that it must raise the debt ceiling to continue spending at that level.

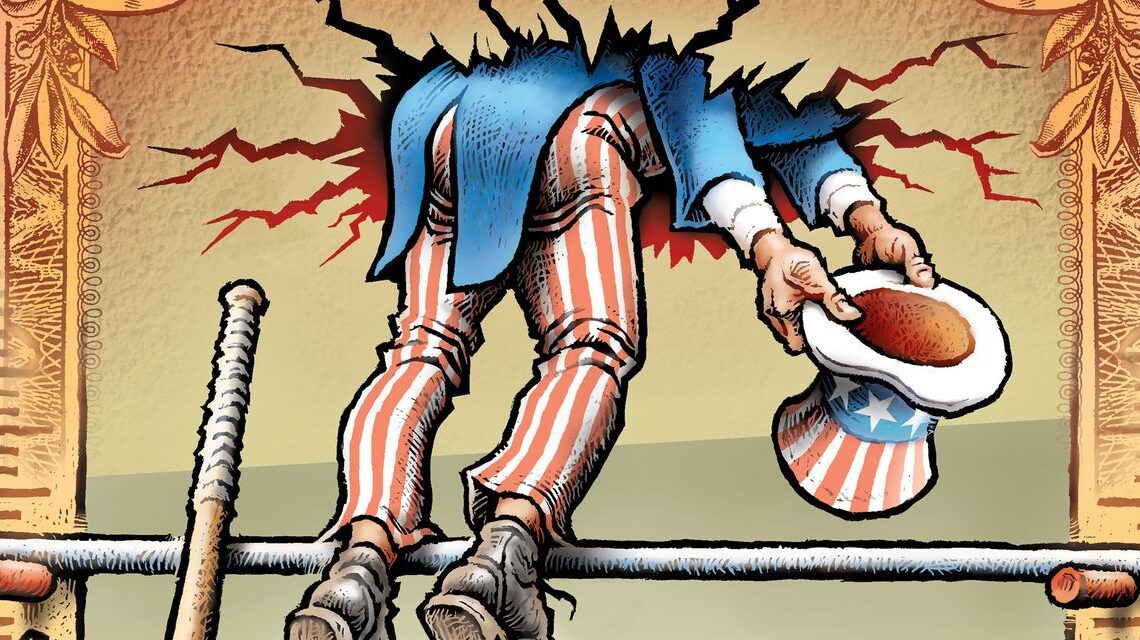

The proposed debt increase will take the level of publicly held federal debt significantly above GDP and put the nation in a position where, if the real interest rate on government debt exceeds the real growth rate in GDP, just paying the annual interest on the national debt will cost more than that year’s growth of all real wages, interest and profits in the American economy.

The Biden administration and the Democratic Congressional leadership admonish Republicans to do the “responsible” thing by raising the debt ceiling to continue the post-pandemic spending surge. President Biden has called Republican efforts to use the debt ceiling to rein in spending “fiscally demented.” In holding the “debt limit hostage,” Treasury Secretary

Janet Yellen

says Republicans could do “irreparable harm to the U.S. economy.” But at what point does not raising the debt ceiling become less irresponsible than continuing current policy and allowing the country to go broke?

Despite outcries from Democrats and the media, using the debt ceiling to try to rein in spending is hardly a new idea. Since 1985 when Sen. Biden joined a bipartisan effort to adopt Gramm-Rudman-Hollings as a rider to the debt ceiling, the debt ceiling has been raised 50 times, and riders have been adopted as part of raising the debt…

Click Here to Read the Full Original Article at RSSOpinion…