The latest Market Talks covering Technology, Media and Telecom. Published exclusively on Dow Jones Newswires at 4:20 ET, 12:20 ET and 16:50 ET.

1352 ET – TUI AG’s shares show valuation upside since its rights issue derating with the current level appearing reasonable, says Citi in a note upgrading the stock to neutral from sell. The reasons for the German travel group’s sharp derating were likely more technical than fundamental, Citi says. “The volatile and uncertain economic outlook combined with the recent share price performance driven by the rights issue dynamics also to some extent highlights the limited institutional investor interest,” say analysts Leo Carrington and Daniela Riu. Citi cuts its target price to 750 pence from 813 pence. London-listed shares topped the FTSE 250 on Thursday and closed up 12% at 624 pence, after the tour-operator’s Easter update and positive outlook for the summer. YTD, shares are down 12%. (elena.vardon@wsj.com)

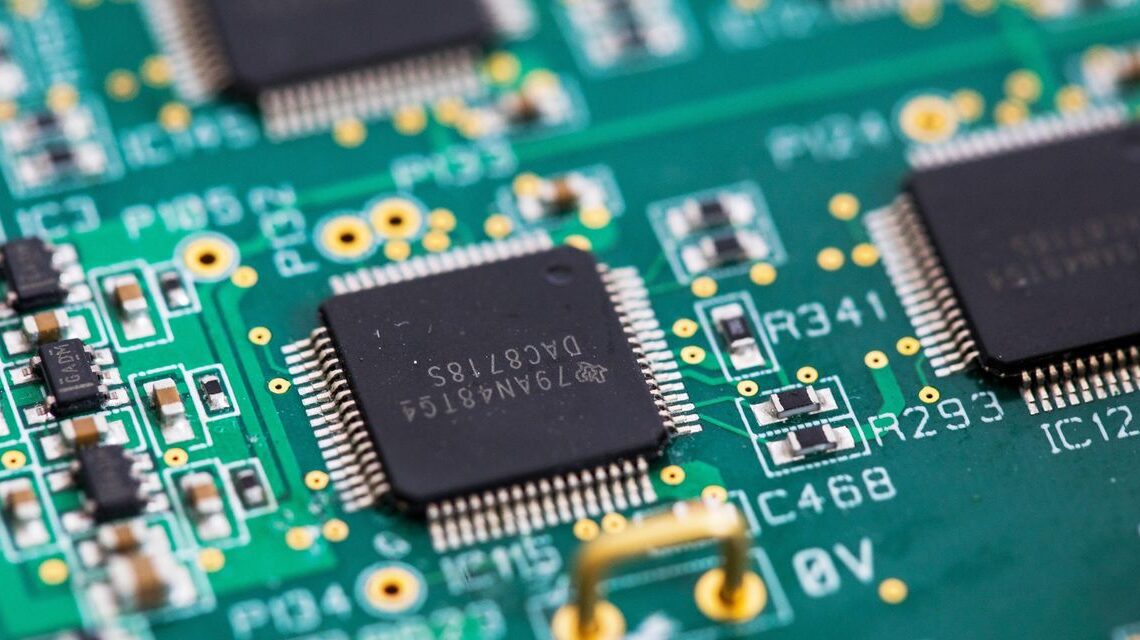

1059 ET – Infineon’s expected new guidance at the midpoint should exceed the EUR16 billion threshold, M.M. Warburg analyst Malte Schaumann writes in a research note. Infineon recently upgraded its full-year revenue guidance after setting an over-cautious target in February, the analyst says, noting that the upgrade was likely thanks to continued strong demand from automotive and industrial customers. However, the German chip maker is expected to upgrade it once more along with 2Q results in early May. “Even with the assumption of a more conservative dollar exchange rate in light of the recent dollar weakness, the new guidance midpoint should exceed the EUR16 billion threshold,” Schaumann says. Warburg lifts its price target to EUR48 from EUR45 and keeps a buy rating on the stock. Shares are up 1% at EUR35.13. (christian.moess@wsj.com)

0930 ET – Mergers and acquisitions among European telecommunications companies over the past quarter-century destroyed more value than they have created on aggregate, but the current background could offer some opportunities, Credit Suisse analysts say in a research note. Smaller players have historically been favored by telecom M&A as an investment theme, CS says, citing Inwit and Royal KPN as potential gainers. Interest in deal-making in the sector is picking up, with European Union officials and company executives recently talking about a return of cross-border transactions, CS says. While cross-border M&A should be viewed with…

Click Here to Read the Full Original Article at WSJ.com: World News…