NEW YORK — If, as expected, the Federal Reserve raises interest rates yet again Wednesday in its drive to cool inflation, much of America will be directly affected.

Rates on credit cards, mortgages and auto loans, which have been surging since the Fed began raising rates last year, all stand to rise even more. The result will be more burdensome loan costs for both consumers and businesses.

On the other hand, many banks are now offering higher rates on savings accounts, giving savers the opportunity to earn more interest.

Economists worry, though, about whether the Fed’s streak of 10 rate hikes since March 2022 will eventually cause the economy to slow too much and cause a recession.

Here’s what to know:

WHAT’S PROMPTING THE RATE INCREASES?

The short answer: Inflation. Inflation has been slowing in recent months, but it’s still high. Measured over a year earlier, consumer prices were up 5% in March, down sharply from February’s 6% year-over-year increase.

The Fed’s goal is to slow consumer spending, thereby reducing demand for homes, cars and other goods and services, eventually cooling the economy and lowering prices.

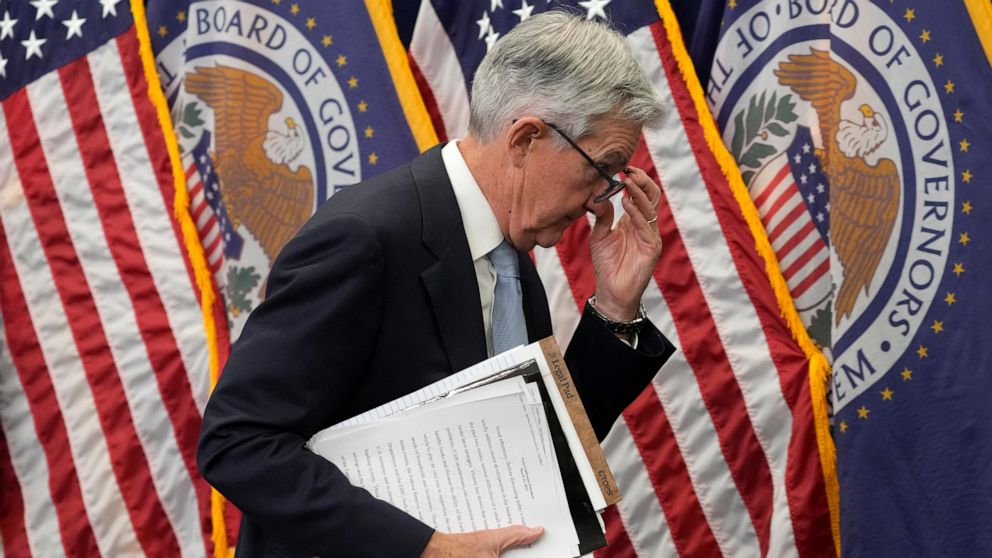

Fed Chair Jerome Powell has acknowledged in the past that aggressively raising rates would bring “some pain” for households but said that doing so is necessary to crush high inflation.

WHO IS MOST AFFECTED?

Anyone borrowing money to make a large purchase, such as a home, car or large appliance, will likely take a hit. The new rate will also increase monthly payments and costs for any consumer who is already paying interest on credit card debt.

“Consumers should focus on building up emergency savings and paying down debt,” said Greg McBride, Bankrate.com’s chief financial analyst. “Even if this proves to be the final Fed rate hike, interest rates are still high and will remain that way.”

WHAT’S HAPPENING WITH CREDIT CARDS?

Even before the Fed’s latest move, credit card borrowing had reached the highest level since 1996, according to Bankrate.com.

The most recent data available showed that 46% of people were carrying debt from month to month, up from 39% a year ago. Total credit card balances were $986 billion in the fourth quarter of 2022, according to the Fed, a record high, though that amount isn’t adjusted for inflation.

For those who don’t qualify for low-rate credit cards because of weak credit scores, the higher interest rates are already affecting their balances.

HOW WILL AN INCREASE AFFECT CREDIT CARD RATES?

The Fed…

Click Here to Read the Full Original Article at ABC News: Business…