The trustee overseeing the bankruptcy of Ontario’s self-proclaimed “Crypto King” wants a judge to deny Aiden Pleterski a discharge from bankruptcy until he pays back more than $4.5 million in assets and funds the trustee says Pleterski hasn’t accounted for.

In its latest report, the trustee — accounting firm Grant Thornton — says the 25-year-old has yet to provide evidence of where a $360,000 watch he purchased ended up, and hasn’t accounted for more than $2.7 million worth of cryptocurrency, along with more than $500,000 he spent on platforms used to buy and sell digital assets — primarily for video games online.

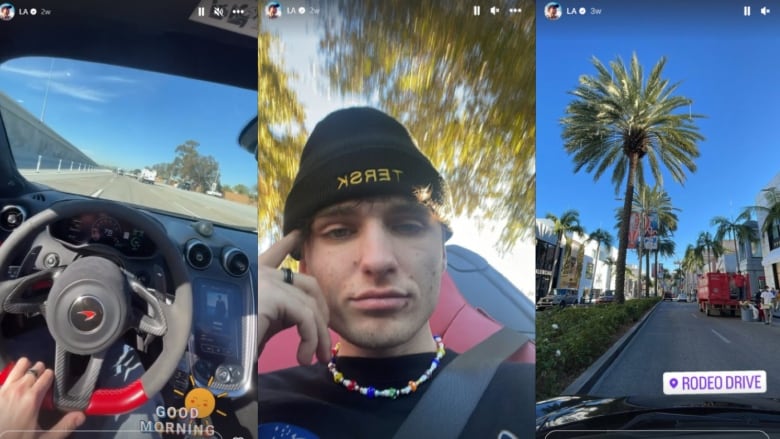

“Given Pleterski’s history and continued lack of co-operation, the trustee is very concerned that Pleterski’s continued travel and extravagance is being funded by assets that should be surrendered to the trustee,” wrote Jake Wiebe, senior vice-president at Grant Thornton in the trustee report.

“Pleterski has maintained his lavish pre-bankruptcy lifestyle and the trustee has concluded that the undisclosed assets are likely being used to fund this lifestyle.”

The report also sheds light on how Pleterski paid for some of that lifestyle last fall. The “Crypto King” used $13,000 worth of Scene points from his credit card on luxury hotels and round-trip flights to Los Angeles and Australia.

Pleterski charged with fraud last week

All of this comes just over a week after Pleterski was charged with fraud over $5,000 and money laundering following an 18-month joint investigation between Durham Regional Police and the Ontario Securities Commission.

Police allege Pleterski solicited funds from investors, promising massive profits and guaranteeing no losses from their original investment. When investors couldn’t access the money they provided to him, many of them reported the situation to police.

He was released on bail on May 14, with his parents putting up a $100,000 surety that he will follow his bail conditions. Those include surrendering his passport, not contacting investors, refraining from making any social media posts involving financial matters, such as soliciting investments, and not buying or trading cryptocurrencies.

Click Here to Read the Full Original Article at CBC | Top Stories News…