Conservative Leader Pierre Poilievre’s call for a summer gas tax holiday became a topic of heated debate in the House of Commons this week, with the Conservatives and Liberals arguing over how much the proposal would actually save Canadian families.

After the Liberals and some experts questioned how much the Conservative proposal would really save Canadians, the Tories shared their math with CBC News. But academics and at least one gas price analyst are still questioning how realistic those estimates are.

In May, Poilievre said the federal government should give Canadians a break on various federal fuel levies on diesel and gasoline between Victoria Day and Labour Day.

Three federal levies — the federal carbon tax, the excise tax and the GST — apply to these fuels across much of the country but not everywhere.

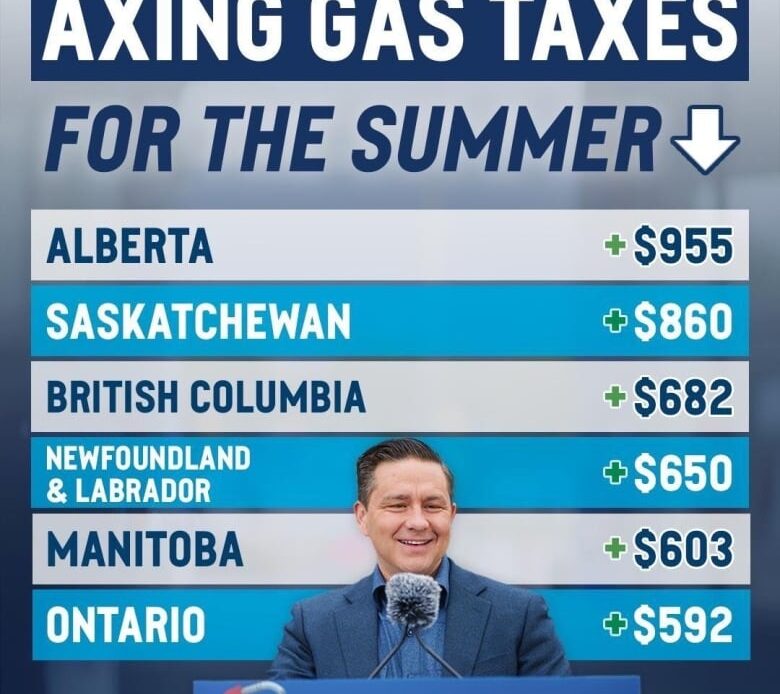

The Conservative leader says his proposal could save a family as much as $955. On Thursday in the House of Commons, Poilievre said the average savings would be $670.

“We’re asking for a tax holiday on fuel. That would save 35 cents a litre and allow families to get in their car, go on the road, do some camping,” Poilievre said.

Later in the day in question period, Liberals mocked the Conservatives’ math.

“This is a prime cut of Conservative baloney,” said Environment Minister Steven Guilbeault. “You can go from the North Pole to the South Pole and you would have kilometres left to achieve the savings that they claim.”

The opposition leader’s director of media relations, Sebastian Skamski, explained how the party arrived at those numbers.

The Conservatives estimate the average family will use 595 litres of fuel over the summer. They say that in a province like Ontario, removing both the GST and excise tax would cost the federal government 18 cents per litre of fuel.

Conservatives are relying on an often-cited report from the Parliamentary Budget Office (PBO) to calculate the impact of removing the carbon tax. Conservatives used the PBO’s net fiscal and economic analysis of the carbon tax to calculate the total savings for households from removing the federal fuel levy, Skamski said. (The PBO report examined all fuels, including home heating fuels — not just gasoline and diesel.)

Several academics who reviewed the Conservatives’ math agreed that their proposal would result in savings for Canadians — but…

Click Here to Read the Full Original Article at CBC | Top Stories News…