Stock photo: Getty Images

The IMF’s updated baseline scenario for Ukraine anticipates the war ending by late 2025, while the downside scenario predicts it continuing until mid-2026.

Source: The sixth review under the IMF’s Extended Fund Facility for Ukraine

Details: The IMF’s baseline scenario for Ukraine maintains that Russia’s war against Ukraine will conclude by late 2025.

Advertisement:

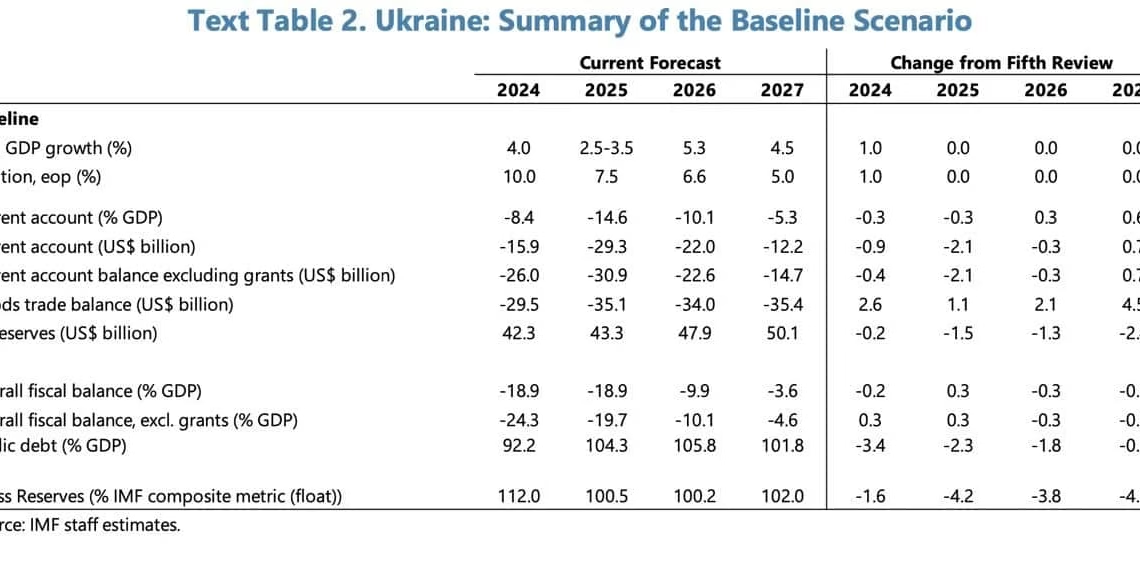

In its sixth review, the IMF projects Ukraine’s real GDP growth to reach 4% year-on-year in 2024, a 1 percentage point increase from its previous forecast.

The IMF also notes that the economic impact of the winter electricity shortage may be less severe than initially anticipated, citing business investments in private generation capacity, expanded import potential from Europe, and ongoing efforts to repair and enhance generating capacity and distribution networks.

Year-end inflation has been revised upward by 1 percentage point to 10%, driven by rising raw food prices affecting staple goods, currency depreciation effects from previous periods, wage growth and energy costs.

The forecast for real GDP growth in 2025 remains at 2.5-3.5%. This projection reflects the potential boost from accelerated energy capacity repairs in 2024 and the launch of new facilities in 2025, balanced against the impact of a tighter labour market, which is expected to drive income and consumption growth as price pressures ease.

The average inflation forecast has also been adjusted, rising by 1.3 percentage points to 10.3% compared to the previous IMF review.

Analysis of economic indicators under the IMF baseline scenario.

Photo: IMF

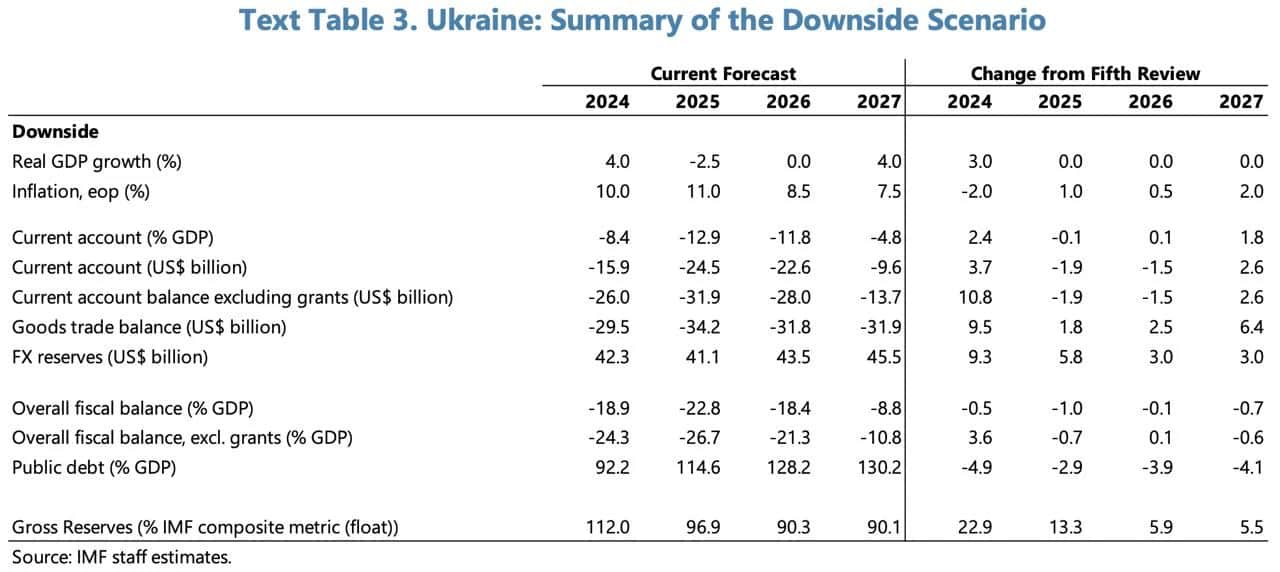

The IMF’s downside scenario assumes a more protracted war, ending in mid-2026.

The scenario implies a longer and more intense shock to economic activity, fiscal needs, and the balance of payments compared to the baseline scenario, with corresponding implications for macroeconomic policy.

The total external financing gap under the worst-case scenario is US$177.2 billion, compared to US$148 billion under the baseline scenario.

The downside scenario also envisages a decline in real GDP followed by a slow recovery, higher and more persistent inflation, a deterioration in the current account balance excluding grants, international reserves remaining below 100% of the ARA criterion until 2027 and the overall deficit excluding grants remaining above 20% until 2026.

Analysis of economic indicators of the IMF’s downside scenario.

Photo:…

Click Here to Read the Full Original Article at Ukrainska Pravda…