The Federal Reserve’s delayed response to inflation has hurt the economy and the central bank’s credibility. This helps explain Chairman

Jerome Powell’s

forceful affirmations of the Fed’s commitment to its 2% inflation target. Bringing inflation back down to target will involve short-term pain, but letting it run at elevated levels will prove more costly in the long run.

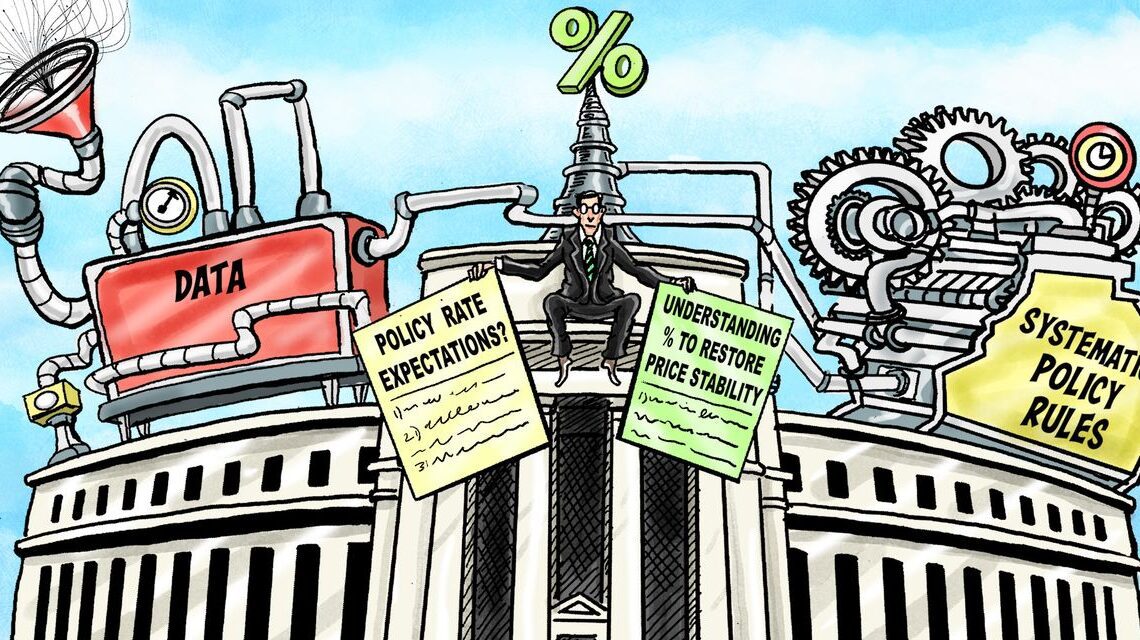

Both the Fed and financial market participants believe that the central bank will succeed in restoring price stability. They increasingly disagree, however, about what it will take to do so. Markets now project a federal-funds rate peaking below 5% and then falling later this year. The Fed’s projections have the funds rate rising above 5% and staying there into 2024.

This disconnect reflects the Fed’s credibility challenge, avoidable communication gaffes, and a broader lack of transparency. In particular, the Fed has been vague about how much tightening will be required to achieve its price stability goals, saying only that it will tighten until interest rates are “sufficiently restrictive,” without providing much guidance about what that means.

Fortunately, there is a well-established body of research in monetary economics that provides concrete guidance on what it will take to restore price stability. This work is grounded in historical experience and a range of compelling economic models. Systematic monetary policy rules, such as those proposed by

John Taylor,

embody patterns of policy response that have been successful at reducing inflation in the past. When talking about the likely future path of interest rates, Fed officials should cite the quantitative implications of these rules and remind markets that they are explicitly data-dependent. These rules typically call for the policy rate to rise with inflation and decline with weakening real activity, such as rising unemployment.

The Fed regularly publishes the current prescriptions of a set of widely studied policy rules and the Cleveland and Atlanta Feds post do-it-yourself calculators online. Federal Open Market Committee members can highlight, without tying policy mechanically to any specific formula, that the interest-rate path required to bring inflation successfully back to its 2% target is likely to be aligned with the prescriptions of a set of monetary policy rules….

Click Here to Read the Full Original Article at RSSOpinion…